Journal Entry for Sale of Merchandise Cash or Account

The idea behind this is related to getting rid of on-hand inventory. When you sell it, you reduce the liabilities you have with inventory. However, it also increases the total cost of goods sold for your business. Think in terms of the timing of inventory orders and cash flow needs.

Aspire Johnson County holds workshop on home sales, affordable … – Daily Journal

Aspire Johnson County holds workshop on home sales, affordable ….

Posted: Thu, 03 Aug 2023 20:20:10 GMT [source]

Further , on Sales of goods on Credit to ABC Co., the company has a receivable from ABC Co. or in other words the asset of the company is increased. Hence before extending credit to customers, the companies outline the terms of the credit on their invoice. This is done so that the customer that is making the purchase will have a clear knowledge of the conditions upon which the credit has been extended to them. Assuming James & Hardy is a law firm that provides various consultancy services and legal representation for their clients.

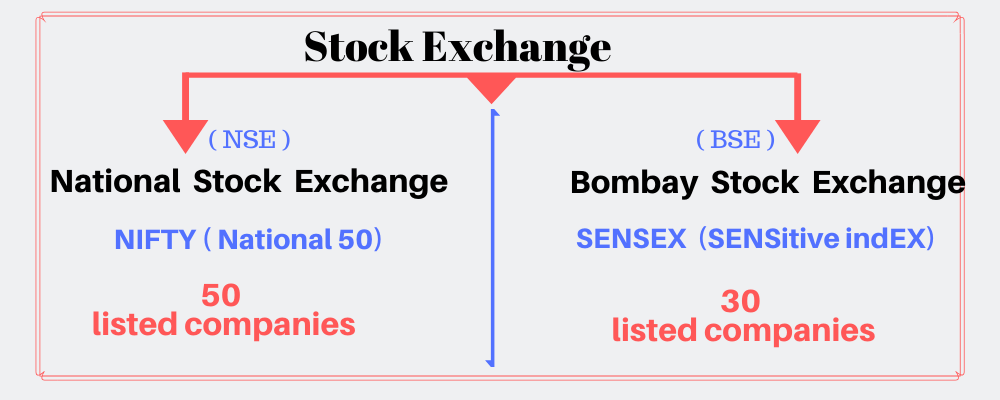

Business Studies Class 11 MCQ

If tax will be paid for the service, the journal entry will involve the cash, service revenue and tax payable accounts. One example of a special journal is the sales journal which is used exclusively for a company’s sales of merchandise to customers that are allowed to pay at a future date. The sales journal will have only one column in which to enter the amount of each sales invoice. At the end of the month the total of the column is debited to Accounts Receivable and credited to Sales. Creating a credit sales journal entry usually involves a debit to the account receivable and a debit to the sales account.

However, sales of assets such as land, building, and furniture are not recorded in the sales journal because they are sold infrequently. For locations with sales taxes, you also need to record the sales tax that your customer paid so you know how much to pay the government later. If your customer uses a credit card to buy the item, you’ll debit accounts receivable instead of cash since it’s income that you’re owed, but you haven’t been paid yet. Now, let’s say your customer’s $100 purchase is subject to 5% sales tax. When you sell something to a customer who pays in cash, debit your Cash account and credit your Revenue account.

Here’s how Little Electrode, Inc. would record this sales journal entry. Offering credit to customers implies that they’ll be receiving goods without paying for them immediately. Because of this, a different method of recording sales has to be used. Receivable accounts are any accounts that record how much a customer owes to your business. The main sources of cash receipts are two; Cash from cash sale and cash from accounts receivable.

Meaning of Sales

Sales simply means to transfer something, whether goods or services , by receiving for it , either at the time when the goods are transferred or at a later date. Sales Journal Entry is the accounting entry made in the books of accounts, to record either of these two situations. The reason you record allowances and returns in a separate account is because it helps you keep track of revenue losses from customers that change their minds or products with quality issues.

- One example of a special journal is the sales journal which is used exclusively for a company’s sales of merchandise to customers that are allowed to pay at a future date.

- By using this feature, business owners can record financial data in the books accurately and efficiently, while providing accountants with the necessary financial data for analysis.

- In order for either of these to happen, the company produces goods or renders services to its customers in exchange for payment.

- For locations with sales taxes, you also need to record the sales tax that your customer paid so you know how much to pay the government later.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Luckily, advances in modern technology enabled us to automate this demanding routine. Without creating an update to accounts, your general ledger will be off. Further , on Sale of Furniture on Credit to Nived., the company incurs a liability towards Nived, or in other words the asset of the company is increased.

Cash sales journal entry example five

It usually indicates when the amount owed is due for payment, any sales discount for the purchase as well as any applicable late payment fees or interest. At the end of the month, the amount column in the journal is totaled. This total is then posted as a debit in the accounts receivable control account and as a credit to the general ledger sales account.

Now, when it comes to sales of inventory, there are actually two entries that must be made into the accounting system. The first entry records the actual sale with a debit entry to an asset account and a credit entry to a revenue account. The second entry requires a debit to the cost of goods sold account and a credit entry to the inventory account. The cash and cost of goods sold accounts are debited while the sales revenue, inventory, and sales tax payable accounts are credited. The debit to the cash and cost of goods sold account signifies an increase in the balance of the accounts.

When companies offer credit to customers, the customers receive goods or services from the company without paying for them immediately. As a result, it increases the amount owed to the company by customers. An increase in credit sales shows that more customers are taking advantage of the credit sales that are offered by a company.

Q: Why are journal entries for sales important?

After they’ve been entered, the accounts should all balance out. This is the best way to keep track of sales during your accounting period. The use of special journal and subsidiary ledgers can make the accounting information system more effective and allow for certain types of information to be obtained more easily.

When a sale is made on credit, a debit to accounts receivable is created. Just like with a cash sale, an entry may need to be made regarding sales taxes. Let us have a look at how the various credit sales journal entries are actually recorded during the course of the daily operations of companies. Since Mrs. Croline charges $39 per hour and she spent 4 hours cleaning Mr. Billy’s house, the amount recorded is $39 x 4 which is equal to the $159 recorded in the cash sales journal entry. Although some companies may record the sale as a debit to their bank account instead of the cash account, most companies prefer to record it to the cash account as shown above. They do so to keep the journal entry simple and based on the fact that the increase in the company’s bank account balance also means an increase in its cash or current assets.

Sales Returns

This is because there is an increase in the amount of cash due to the cash received and an increase in expense since the goods have been transferred to the customer. A sales journal entry records a cash or credit sale to a customer. It does more than record the total money a business receives from the transaction.

And, you’re increasing your Cost of Goods Sold (COGS) Expense account. In other words, goods are the commodities that are purchased and sold in a business on a daily basis. Goods are denoted as ‘Purchases A/c’ when goods are purchased and ‘Sales A/c’ when they are sold. Since Sale of goods is an income, so, Sales A/c would be credited, because according to the Rules of Debit and Credit, an income A/c is credited . This knowledge can be used to ensure that individual customers have not exceeded their credit limits.

For instance, cash is an asset account, while cost of goods sold is an expense account. But it’s still important to make sure that there’s an accounting record of every sale you make. This way, you can balance your books and report your income accurately. You are a senior accountant at Boomer sales entry in journal Skateboards, a small company that sells skateboards designed for older people who want to try a new experience. The following transactions take place during the month of August. Because of this, the Star sales rep rush ordered them softballs, and the team agreed to return the baseballs.

- The journal entry usually involves a debit to the accounts receivable and a credit to the sales account.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- For cash sales, the first entry requires a debit to the cash account for the actual sales amount and a credit to a revenue account in the same amount.

Or if you prefer a specialist to talk you through the process via a live chat, book office hours with the Synder support team. After the posting, the account number or a check is placed in the post reference (Post Ref.) column. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. How you record the transaction depends on whether your customer pays with cash or uses credit. Read on to learn how to make a cash sales journal entry and credit sales journal entry. Now let’s say that instead of paying for the furniture at the time of purchase, I open a store credit account and I make monthly payments to the furniture store until the furniture is paid in full.

The journal entry for sales made on credit is usually recorded once the customer has purchased the good or service irrespective of when they pay for the goods or services. This is done based on the accrual accounting method where revenue is recorded once it is earned and not when it is paid. Hence companies need to keep tabs on their accounts receivable, ensuring that the details recorded are correct.

‘Every room is an experience’: $15M Summerlin home tops July sales – Las Vegas Review-Journal

‘Every room is an experience’: $15M Summerlin home tops July sales.

Posted: Sun, 30 Jul 2023 17:03:00 GMT [source]

So, instead of adding it to your revenue, you add it to a sales tax payable account until you remit it to the government. There’s a 5% sales tax rate, meaning you receive $25 in sales tax ($500 X 0.05). The best way to record entries is by using flexible accounting software. Many accounting software options allow entries to be created both manually and automatically.