Warren Buffett’s Investment Advice: 9 Top Pieces Of Wisdom For Investing Success

Making money was an early interest for his son, Warren, who sold soft drinks and had a paper route. When he was 14 years old, he invested the earnings from these endeavors in 40 acres of land, which he then rented for a profit. At his father’s urging, he applied to the University of Pennsylvania and was accepted. Unimpressed, Buffett left that university after two years, transferring to the University of Nebraska. Warren Edward Buffett, the legendary value investor, turned an ailing textile mill into a financial engine that powered what would become the world’s most successful holding company. Buffett, the man who pioneered buy-and-hold investing, had been vocal about his distaste for buying companies around their market debut.

Early in the season, when asparagus was scarce, customers grabbed it at $2 a bunch. In late spring, as the stalks became plentiful, she noticed that they sold more quickly if she dropped the price by 50 cents. Kanbrick is no Berkshire copycat, Ms. Britt Cool insisted several times. For instance, she has discarded her mentor’s belief that it’s enough to spot companies with good managers and let them run the show with minimal interference.

He has also served as director of Citigroup Global Markets Holdings, Graham Holdings Company and The Gillette Company. In June, Kanbrick struck its second deal, buying a majority stake in Marine Concepts, which patented a system that simplifies the process of covering boats. ” Ms. Britt Cool wondered as she prepared to stop by Mr. Buffett’s office. In the end, she decided on some corn and tomatoes from the farm as a nod to their shared Midwestern roots. Once, Ms. Knopf, along with some friends, visited the Britt farm and saw her classmate’s drive in action. Ms. Knopf recalled how, though technically on vacation, she was woken up at 5 a.m.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. NVR constructs and sells homes under the brands of Ryan Homes, NVHomes and Heartland Homes. It also has a building products division, a mortgage subsidiary and a settlement and title services subsidiary. In the second quarter of Lennar’s fiscal 2023, which ended May 31, its revenue from home sales slipped 4% year over year to $7.6 billion. The decline was because of a 7% decrease in average sales price, partially offset by a 3% increase in the number of home deliveries. D.R. Horton shares initially surged after Berkshire revealed its stake but later retraced those gains.

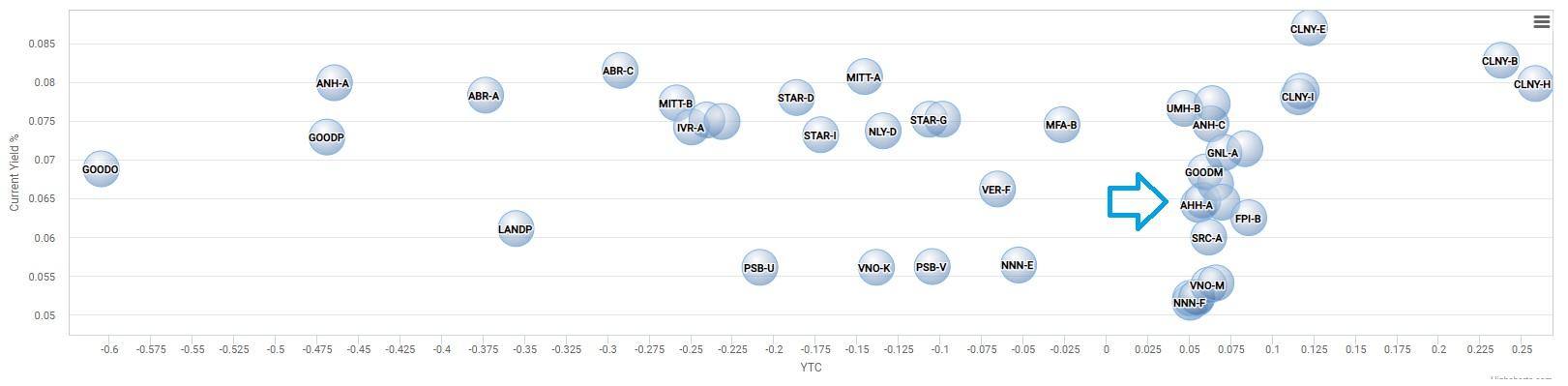

How do you calculate the intrinsic value of a stock?

His starting salary was $12,000 a year (about $131,000 today).[26] There he worked closely with Walter Schloss. He was adamant that stocks provide a wide margin of safety after weighing the trade-off between their price and their intrinsic value. At this time Buffett’s personal savings were over $174,000 (about $1.87 million today)[26] and concurrently founded Buffett Partnership Ltd.

In 1965, when Buffett’s partnerships began purchasing Berkshire aggressively, they paid $14.86 per share while the company had working capital of $19 per share. This did not include the value of fixed assets (factory and equipment). Buffett took control of Berkshire Hathaway at a board meeting and named a new president, Ken Chace, to run the company. He later claimed that the textile business had been his worst trade.[43] He then moved the business into the insurance sector, and, in 1985, the last of the mills that had been the core business of Berkshire Hathaway was sold. After graduating from the University of Nebraska (B.S., 1950), he studied with Benjamin Graham at the Columbia University School of Business (M.S., 1951).

Buffett also has several large stakes in privately-held companies such as GEICO Insurance and Burlington Northern Santa Fe (BNSF) Railroad. Well, Buffett’s success, however, depends on his unmatched Warren Buffett skill in accurately determining this intrinsic value. While we can outline some of his criteria, we have no way of knowing exactly how he gained such precise mastery of calculating value.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Warren Buffett’s advice for college students: Chase the job you’d want if ‘you had no need for money’

Antitrust charges started, instigated by its rival, the Buffalo Courier-Express. That said, Buffett is also a staunch supporter of index funds, which hold every stock in an index, making them automatically diversified. To build wealth, investors should “consistently buy an S&P 500 low-cost index fund,” Buffett said in 2017. “Keep buying it through thick and thin, and especially through thin.”

Despite the success of Buffett Partnership, its founder dissolved the firm in 1969 to focus on the development of Berkshire Hathaway. He phased out its textile manufacturing division, instead expanding the company by buying assets in media (The Washington Post), insurance (GEICO) and oil (Exxon). Immensely successful, the “Oracle of Omaha” even managed to spin seemingly poor investments into gold, most notably with his purchase of scandal-plagued Salomon Brothers in 1987. Buffett often visited his father’s stock brokerage shop as a child and chalked in the stock prices on the blackboard in the office.

Company Performance

Along these same lines, Buffett has been a long-time buyer of Bank of America, a bank with branches across the country and an enviable deposit franchise. As of the first quarter of 2023, it occupies the second-largest position in Berkshire Hathaway’s portfolio and the stake is worth more than $29 billion. In contrast, when investors run away from the market or a specific stock, Buffett becomes more interested because prices are cheaper.

A market where oil supply remains tight is typically a positive for spot prices. More importantly, Coca-Cola has operations in all but three countries globally (North Korea, Cuba, and Russia). This allows it to generate predictable operating cash flow in developed markets while also taking advantage of an estimated 8% to 10% compound annual growth rate in emerging markets through 2026.

Buffett began investing in American Express starting in 1991, buying preferred stock and those converted to common stock in 1994. But Buffett tells us that it’s only when things get tough that we find out who’s really protected and prepared to outlast the storm. At several points in his investing career, Buffett has temporarily appeared out of step with the current climate. But inevitably, the environment shifts and those who once looked smart are revealed to be swimming without their trunks on. Always make sure that your portfolio is positioned to survive a bear market.

- NVR constructs and sells homes under the brands of Ryan Homes, NVHomes and Heartland Homes.

- Buffett started a buyback program in 2011 and has long preferred buying other companies’ stocks and businesses outright.

- Buffett has said in the past that the quality of a company’s management is a major investment factor for him.

That figure swelled to around $21 billion in 1994, a 700-fold rise in 30 years. Berkshire’s assets have ballooned by another 48 times since then, meaning Buffett has overseen a roughly 33,000-fold increase during his tenure as CEO. However, Berkshire holds significantly fewer assets than Wall Street’s largest banks. For example, JPMorgan reported $3.9 trillion of assets last quarter, including $469 billion of deposits and $1.3 trillion of loans. Tesla, which commands a similar market capitalization to Berkshire, held just $91 billion of assets at the end of June.

Warren Buffett

He told her, Ms. Britt Cool said, that it reminded him of when he parted ways with his mentor Benjamin Graham — the famed value investor — in the 1950s to pursue his own career. That gave Ms. Britt Cool a chance to learn about business operations in real life. With Mr. Buffett’s blessing, she traveled to the offices of various Berkshire subsidiaries, meeting with their chief executives and using what she heard to spur connections between different executives. Tracy Britt Cool spent a decade working closely with the renowned investor. Buffett’s wealth is largely due to Berkshire’s most recent decades of financial success, and in his letter, Buffett partially attributed that success to finding people he and Munger enjoy working with. Mr. Buffett had recently been in the spotlight in a debate over how little income tax American billionaires — including himself — pay.

There’s no shortage of stock market analysts and commentators who are willing to tell you what you should be doing with your money at any given time. Here, Buffett reminds investors that being an active trader who constantly switches from position to position isn’t likely to produce great returns. Activity can feel productive in the world of investing, but the only thing that matters is whether you were right in your analysis.

When Buffett invests in a company, he isn’t concerned with whether the market will eventually recognize its worth. He is concerned with how well that company can make money as a business. Earlier this year, energy stock Chevron (CVX -0.34%) was challenging BofA for the No. 2 spot in Warren Buffett’s portfolio. But following two quarters of being pared down, this integrated oil and gas giant is now Berkshire’s fifth-biggest holding by market value. He sold this stake soon afterwards, sparing him the billions of dollars he would have lost had he held on to the company in the midst of the steep drop in oil prices beginning in the summer of 2008. In 1952,[37] Buffett married Susan Thompson at Dundee Presbyterian Church.

- The following 10 stocks are ranked by the percentage share of Berkshire Hathaway’s overall equity portfolio.

- We do not include the universe of companies or financial offers that may be available to you.

- She had met him three times while a student, including on trips arranged by Smart Woman Securities, an investing group for women she had founded at Harvard.

- Buffett purchases what he believes are undervalued stocks and holds them for the long-term through many market fluctuations.

- He purchased See’s Candies with longtime business partner Charlie Munger in 1972 and spent more than $1 billion on Coca-Cola stock in 1988 — both of which turned out to be good bets and both of which he still owns today.

When he makes a purchase, his intention is to hold the securities indefinitely. Coca-Cola, American Express, and Gillette all met his criteria and have remained in Berkshire Hathaway’s portfolio for many years. What do you do with your money when you are the world’s most successful investor? Known as the Oracle of Omaha for his investment prowess, Buffett has amassed a personal fortune in excess of $100 billion, according to Forbes. He inspires legions of loyal fans to make a yearly trek to Omaha, Nebraska, for an opportunity to hear him speak at Berkshire’s annual meeting, an event ironically dubbed the Woodstock of Capitalism.

“Though markets are generally rational, they occasionally do crazy things,” he wrote in his 2018 letter to shareholders. Finding companies that meet the other five criteria is one thing, but determining whether they are undervalued is the most difficult part of value investing. You might initially think of this question as a radical approach to narrowing down a company. He tends to shy away (but not always) from companies whose products are indistinguishable from those of competitors, and those that rely solely on a commodity such as oil and gas.

Wisdom And Courage For A Wall Of Worry From Warren Buffett And Charlie Munger

An additional 1.5 million shares went to a foundation run in honor of his first wife. Upon graduation, his father once again convinced him of the value of education, encouraging him to pursue a graduate degree. Buffett studied under Benjamin Graham, the father of value investing, and his time at Columbia set the stage for a storied career, albeit one with a slow start.